Home / Knowledge & Insights / News / Governance of Solicitors in the UK

Nov 2017

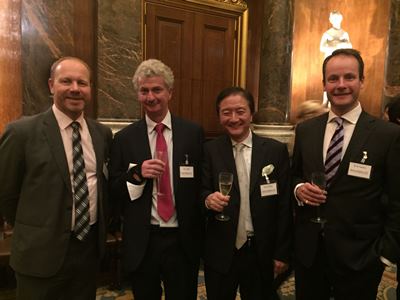

Simone Horrobin and Paul Marsh on behalf of the firm recently hosted a second delegation from the Embassy of Japan. The delegation consisted of an Attorney and Judicial System officer from the Japanese Ministry of Justice, together with the Legal Attaché and interpreter.

The delegation was interested in finding out about the governance of solicitors in the UK, the role of the Law Society, the Legal Services Board and the impact of the Legal Services Act 2007 on the profession.

Special thanks go to Paul Marsh, former President of the Law Society and Consultant of Downs Solicitors, who was able to drawn upon his experience as President and long established legal career to provide an explanation of the governance of our legal system and to provide his views on the subject.